how much are payroll taxes in colorado

A state standard deduction exists and is available for those that qualify for a federal standard deduction. How to Remit Income Tax Withholding.

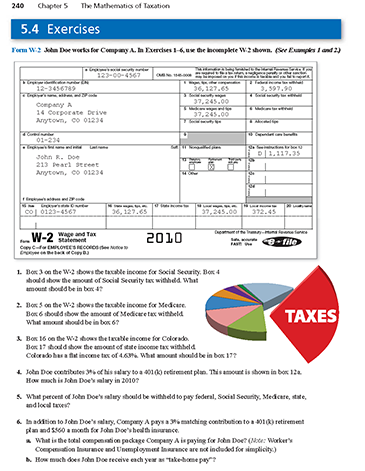

Math You 5 4 Social Security Payroll Taxes Page 240

You pay John Smith 100000 gross wages.

. Figure out your filing status. How to Submit Withholding Statements. Colorado Salary Paycheck Calculator.

How much are payroll taxes in colorado Monday October 10 2022 Edit. One of the new laws HB-1311 will eliminate certain state tax deductions for individuals and households with higher incomes beginning in tax year 2022. Select a tax type below to view the available payment options.

The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. The federal payroll tax flat tax. However because of numerous additional.

Colorado Cash Back. The state income tax rate in Colorado is a flat rate of 455. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator.

Do you receive fair pay. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Payroll tax is 153 of an employees gross taxable wages.

Colorado income tax rate. John has taxes withheld as detailed. Colorado new hire online reporting.

The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales taxes in the country at just 290. If youve already filed your Colorado state income tax return youre all set. Payroll tax is 153 of an employees gross taxable wages.

Colorado State Directory of New Hires. Along with a few other. Colorado New Hire Reporting.

The state levies various. Unlike some other states Colorado does not currently have any sales tax holidays. How to Report Year.

Fast easy accurate payroll and tax so you can. Colorado has no state-level payroll. Revenue Online e-check or credit card with transaction fees or by Electronic Funds Transfer EFT in Revenue Online with.

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. In total Social Security is 124 and Medicare is 29 but the taxes are split. Sign up today to get your personal report.

How much does a Payroll Tax Coordinator make in Colorado. How to File Online. Youll receive your Colorado Cash Back check in the mail soon.

6 to 30 characters long. In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both employee and. How Your Colorado Paycheck Works.

Census Bureau Number of cities that have local income taxes. This expired for 2013. Colorado imposes a 290 sales tax with localities charging 475 for 765 percent.

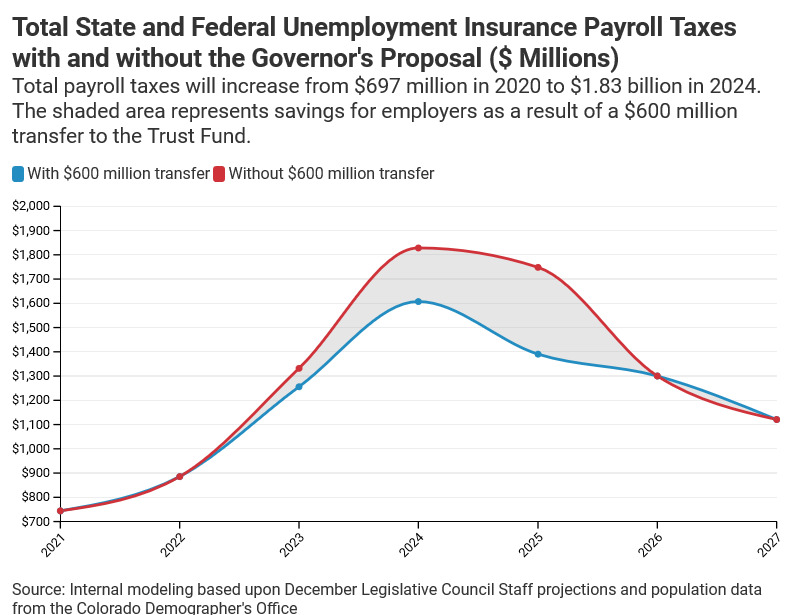

Employers are required to file returns and remit. Filing Frequency Due Dates. The new employer UI rate in Colorado for non-construction trades is 170.

What percentage is payroll taxes. Each tax type has specific requirements regarding how you are able to pay your tax liability.

Idaho Ranks 21st In The Annual State Business Tax Climate Index Stateimpact Idaho

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Colorado Issues New Employee Withholding Certificate For 2022

Colorado Retirement Tax Friendliness Smartasset

Payroll Tax Requirements And Forms Colorado Business Resource Book

Impacts Of Lowering Colorado Businesses 4 4 Billion Tax Bill Common Sense Institute

Colorado Sales Tax Rates By City County 2022

Colorado New Employer Tax Expenses Asap Help Center

State Income Tax Rates And Brackets 2021 Tax Foundation

A Path To Zero Income Tax For Colorado Independence Institute

Colorado Filing Change Notice For Payroll Tax Withholding Asap Help Center

Colorado Retirement Tax Friendliness Smartasset

How Do I Register For A Colorado Sales Tax License When Starting A New Fitness Business

Transitioning To Colorado Wage Withholding Certificate Dr 0004 Youtube

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Payroll Tax Archives Independence Institute